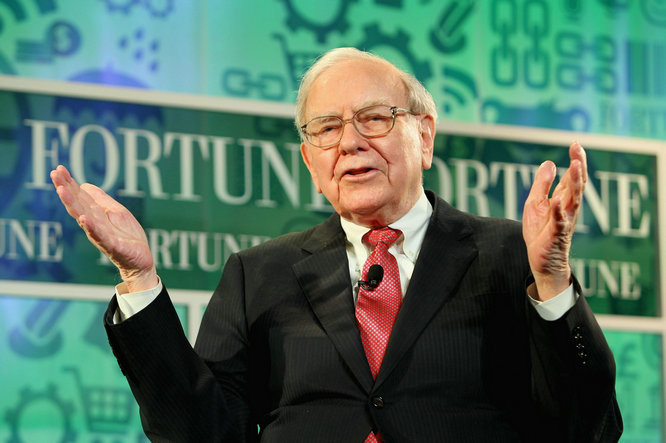

In the ever-changing landscape of global finance, there stands a legendary figure affectionately known as the "Oracle of Omaha," who has woven investment lore with his sagacity and foresight. This man is none other than Warren E. Buffett – a name synonymous with value investing itself. Join us as we delve into the intellectual sanctuary of this master investor, uncovering the secrets to his success through vivid narratives, concrete examples, and authoritative data.

Opening Act: The Omaha Teenage Dreamer

It all began in the 1930s when, while most children were trading baseball cards, young Buffett was already buying and selling Coca-Cola shares with his pocket money, embarking on his entrepreneurial adventure. At 11, he purchased three shares of Cities Service preferred stock at $38 per share, experiencing firsthand the market's volatility and the thrill of discovering value. This early encounter laid the groundwork for his lifelong investment philosophy: "Investing is not about speculating but casting a vote for the future of a business."

In 1951, Warren E. Buffett visit to Government Employees Insurance Company (GEICO) marked a turning point in his career. Through conversations with company executives, he grasped the profitability model of the insurance sector and GEICO's cost advantage, leading him to invest nearly his entire savings of $10,000. Within years, this investment multiplied nearly twentyfold. As Buffett put it, "We favor businesses that generate cash, not consume it." GEICO exemplifies this principle perfectly.

By 1962, Buffett started acquiring shares in Berkshire Hathaway, then a struggling textile mill. He leveraged this platform to transform it into a diversified holding company with stakes in insurance, banking, media, and more. In 1985, despite persistent losses in the textile division, Buffett made the tough call to close it down – a short-term pain for long-term gain, allowing the company to focus on more lucrative ventures in insurance and investments. His decisiveness and courage to pivot embody the business wisdom of "the best use of funds is to reinvest in your own enterprise."

By 1988, through meticulous management of Berkshire Hathaway, Warren E. Buffett had achieved astonishing capital appreciation. Between 1965 and 1987, the book value per share of Berkshire soared from a modest 19toanimpressive3,170, reflecting a staggering compound annual growth rate of 23.3%—vastly outpacing the S&P 500’s return of 11.1% over the same timeframe. These figures are more than just cold statistics; they are the tangible evidence of the triumph of Warren E. Buffett value investing philosophy, a testament to his patience, rational decision-making, and the rewards of steadfast adherence to his principles.

Core Case Study: The Sweet Investment in Coca-Cola

"Investing is not complicated; it's about buying excellent companies at reasonable prices." —Warren E. Buffett famous adage encapsulates his approach to investing in Coca-Cola. In 1988, while the market was cautious about Coca-Cola's growth prospects, Buffett saw a different picture. To him, Coca-Cola was more than just a soda—it embodied the "American Dream" with a century-old heritage, universal brand recognition, and an extensive distribution network.

Between 1988 and 1989, Berkshire Hathaway, under Warren E. Buffett guidance, gradually accumulated a 7% stake in Coca-Cola at a total cost of approximately $1.3 billion. This move stirred controversy, with many questioning whether he overestimated the potential of the traditional beverage maker. Buffett, however, was confident in Coca-Cola's core strengths: unwavering brand loyalty, unparalleled global market penetration, and steady cash flows.

Warren E. Buffett assessment proved accurate. By 1998, Berkshire's investment in Coca-Cola had soared to $13 billion, nearly a tenfold increase in a decade. This excludes the consistent dividend income over the subsequent decades. Despite market fluctuations, Coca-Cola remained a steadfast performer in Warren E. Buffett portfolio, validating his long-term investment strategy.

Beyond financial returns, Warren E. Buffett Coca-Cola investment serves as a living testament to his investment philosophy. He often said, "If you aren't willing to own a stock for ten years, don't even think about owning it for ten minutes." His long-term view and preference for straightforward business models have kept his mind clear amidst market complexities. Emphasizing the importance of a company's intrinsic value over fleeting market sentiment, his "buy-and-hold" strategy bore the fruit of time in the Coca-Cola investment.

In-Depth Analysis: Opportunities Amidst Crisis

Warren E. Buffett famous adage rings particularly true on the eve of the 2008 Financial Crisis: “It's only when the tide goes out that you learn who's been swimming naked.” As the shadow of the subprime mortgage crisis cast a gloom over the globe and panic gripped most investors, Buffett responded with an unusual calm and prescience, readying himself to seize the “discounted opportunities” presented by the market.

With the collapse of Lehman Brothers marking a nadir in market confidence, Buffett embarked on his “shopping spree.” He first came to the aid of Goldman Sachs, purchasing $5 billion in preferred stock and receiving warrants, a move seen as a vote of confidence in the financial system. Soon after, he snapped up General Electric’s preferred stock at a bargain, demonstrating his unique ability to spot and seize quality assets amidst turmoil. These actions not only reaped substantial financial rewards for Berkshire Hathaway but also bolstered market morale.

Far from impulsive, these decisions stemmed from Warren E. Buffett unwavering commitment to value investing and deep understanding of businesses. He believes, “The secret to investing is to be fearful when others are greedy and greedy when others are fearful.” Amid widespread pessimism, he saw the enduring worth of great companies beyond their fluctuating share prices. By investing in firms with strong economic moats and stable cash flows, Buffett constructed a safety net in times of crisis.

Statistics attest to the fruits of Berkshire’s investments during the 2008-2009 crisis, yielding substantial returns. The Goldman Sachs investment doubled in value when converted to common shares years later, and the General Electric bet also paid off handsomely. These instances validate Warren E. Buffett strategies and highlight his capacity for cool-headed analysis and bold moves in extreme market conditions.

Data Backing: Figures Behind the Performance

Warren E. Buffett guiding principle since taking the helm of Berkshire Hathaway in 1965 has been, “Rule No.1: Never lose money. Rule No.2: Never forget rule No.1.” What began as a struggling textile mill with a book value of $19 per share transformed over the next half-century.

From 1965 to 2023, Berkshire’s book value per share skyrocketed thousands of times, with a compound annual growth rate surpassing the S&P 500. A $10,000 investment in Berkshire in 1965 could have turned into millions or even tens of millions by 2023. These numbers are not merely statistical leaps but the result of time and wisdom in concert.

Case Studies in Value

See's Candies: Warren E. Buffett $25 million acquisition in 1972 seemed costly but proved a sweet spot in Berkshire’s portfolio due to the candy business's stable cash flow and brand strength. It underscores that exceptional businesses reward patience.

Coca-Cola: Warren E. Buffett major 1988 investment in Coca-Cola reinforced his faith in brand power. Over time, it became one of Berkshire’s most successful ventures, illustrating the wisdom of investing in great companies and then letting them grow.

“Price is what you pay, value is what you get.” Warren E. Buffett investment philosophy centers on understanding a business's intrinsic value and buying when its market price falls below this value. He advocates for long-term holdings tied to a company’s fundamentals rather than market sentiment.

Epilogue: A Legacy of Wisdom

Though Buffett has reached an advanced age, his market acumen and adherence to value investing continue to inspire investors worldwide. His philanthropic endeavors with Bill Gates elevate wealth accumulation to societal contribution. His advice, “Ultimately, the greatest investment one can make is in oneself,” sums up his success and motivates aspirants.

Warren E. Buffett tale is one of wisdom, courage, and the brilliance of human spirit. Amidst market fluctuations, his investment philosophy shines like a beacon, guiding those pursuing lasting value, proving that in complexity, simple yet profound truths prevail.